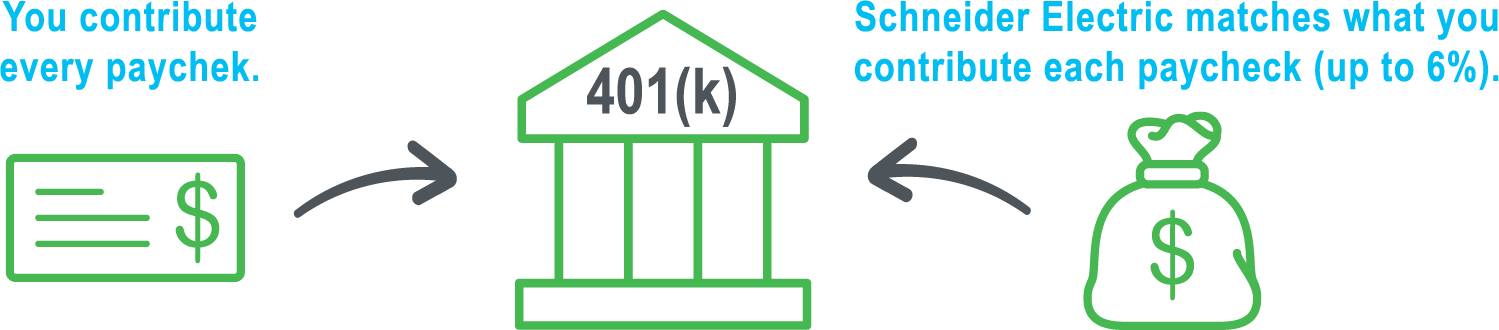

Your Schneider Electric 401(k) Plan helps you save for your retirement.

Your 401(k) is always yours.

You are 100% vested on your date of hire. This means you have complete ownership of both your contributions and Schneider Electric’s contributions.

Contributing to the plan

You can make any combination of pre-tax, Roth after-tax, and, if eligible, catch-up contributions to your regular 401(k) and to your separate STIP/SIP election.1

- When you are newly hired: You are automatically enrolled with a 3% contribution (approximately 30 days after your hire date for your regular earnings election and your STIP/SIP election). You can make changes to your account at any time. If you contributed to a prior employer’s 401(k) plan this year, you may need to adjust your contribution to avoid exceeding the IRS limit.

- Auto-increase of your contributions: Your contribution will automatically increase by 1% each year until you reach a 6% contribution rate (for your regular earnings election and your STIP/SIP election). You can opt out of this program.

- Changing your contributions: You can increase, decrease or stop contributions at any time.

- The most you can contribute: In 2024, you can contribute up to $23,000 (combined pre-tax and Roth). If you are age 50 or older in a plan year, you can contribute an additional $7,500 (your catch-up contribution).2

- Investment fund options: You can invest in Retirement Solution Funds (known as target date funds) and Core Funds. You can change how your account is invested at any time.

- The separate STIP/SIP election can be different or the same as your regular 401(k) contribution.

- These contribution amounts are adjusted by the IRS and may increase for 2025. Visit Rewards@Schneider for current limits.

Take advantage of the Company match.

When you contribute, Schneider Electric matches $1 for $1 of the first 6% you contribute to the plan each paycheck. The Company match is based on your total contribution (pre-tax, Roth and catch-up contributions) and is considered a pre-tax match contribution that is taxable when withdrawn.

Learn more.

Learn more about the 401(k) plan on Rewards@Schneider. Find interactive tools, calculators, videos and articles to help you decide how much to contribute and prepare for your financial future at myseretirement.com, through the Empower app or by calling 833-738-7473.