- Review this benefits guide for an overview of your benefit options for 2024, instructions to enroll, information on how to use the Company-provided Benefit Bucks and costs for coverage.

- Could your health plan be saving you more money? Review your 2024 benefit options with ALEX, your personalized benefits counselor, who helps you evaluate the benefits that provide the best value and offers easy-to-understand explanations to your questions. ALEX can also help you with your 401(k) decisions and provide Medicare information. Or use the new ALEX Go — a text-based version of ALEX who will give you a plan recommendation in 5 minutes! You can even use ALEX Go to compare your family member’s medical plan with your medical options. Access ALEX at start.myalex.com/se. Ya está disponible en español.

- Schedule an appointment with a My Secure Advantage (MSA) money coach to review the pros and cons and ins and outs of your benefit options to give you confidence in your ultimate decisions. Search “MSA” on Rewards@Schneider to learn more.

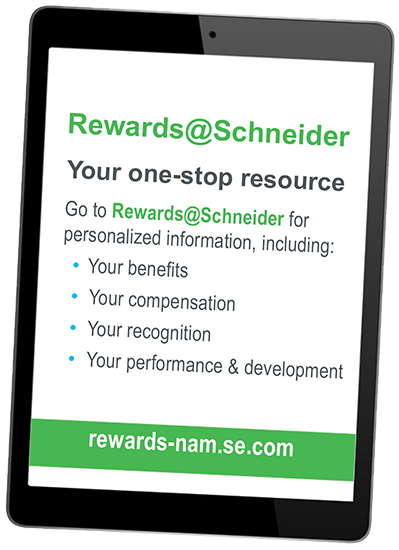

- Visit Rewards@Schneider — during enrollment or anytime during the year — to find details on your benefits and other helpful resources.

- Access BenefitsLink (the enrollment site) at se-benefitslink.com if you are a new hire or to apply Benefit Bucks to a benefit or fund your Life Planning Account | change your current coverage | add or remove a dependent | elect a new benefit for 2024 | enroll (or re-enroll) in an FSA, HSA, PTO Purchase Program and/or Recharge Break Program | change your responses to fee questions.

- Double check your dependents to make sure the right family members have the necessary coverage and are eligible dependents.

- Review and update your life insurance beneficiary designations if needed.

- Complete your evidence of insurability (EOI) on receipt from Unum for life insurance or MetLife for LTD Buy-up if you added or increased these benefits.

- Review your benefit enrollment notifications from Alight at se-benefitslink.com. Add your mobile phone number for verification purposes and password resets. You can also select which email you prefer to receive your benefit enrollment notifications from Alight. Need to update your email address? Visit TalentLink to edit your email address.

- Confirm your elections. Save (or print) your final benefit summary. A confirmation statement will also be sent to your BenefitsLink mailbox.

- Submit documents to verify your dependent’s eligibility. See the documents you need to submit.

- Compare your deductions on your first paycheck to the deductions on your benefit summary. If the deductions do not match, contact PeopleLink immediately to report the difference.

Answer the pre-enrollment questions

Tobacco status questions for medical and life insurance

Answer these questions for yourself and any dependents you intend to cover. If you do not complete these questions, or if you use tobacco and/or smoke products, you will pay:

- Tobacco-user fee of $50 per month for medical coverage, and

- Tobacco-user rates for Employee Supplemental Life and Spouse/Domestic Partner Life Insurance, if elected.

You can avoid the fee/higher costs if you use tobacco and/or smoke products but enroll in the free, Company-provided, Quit For Life® Program.

Spouse/domestic partner medical coverage questions

If you choose to cover your spouse/domestic partner who has coverage available through their own employer, or you don’t indicate whether your spouse/domestic partner is eligible for medical coverage through their own employer, you will pay a $75 monthly fee in addition to the cost for your medical coverage level.

Schneider Electric family member questions

If you have a family member who also works for Schneider Electric (spouse/domestic partner, parent or child), there may be plan rules that could impact your enrollment. Answer the pre-enrollment questions to understand any applicable plan rules for your family situation.

Health Savings Account (HSA) eligibility questions

Whether you are eligible to participate in the HSA determines the medical options you may enroll in.